Once upon a time,offshore accounts was popular with various global trading enterprises with low taxes or even tax-free,foreign exchange freedom to facilitate international trade and other advantages,so that Hongkong, the British Virgin Islands,Seychelles, Cayman Islands,Panama and other places become famous of the "tax haven".

曾几何时,离岸账户受到全球各类贸易企业的热捧,低税甚至免税、外汇自由、方便国际贸易等种种优势,让香港、英属维尔京群岛、塞舌尔群岛、开曼群岛、巴拿马等地成为风光无限的“避税天堂”。

But now, these "tax haven" are no longer the same past scenery.

但是现在,这些“避税天堂”却不复往日风光。

Global countries are focusing on the "tax haven".

全球围剿“避税天堂”

These offshore companies can help many enterprises with international trade, but at the same time, they also create opportunities for the lawless persons to do something bad, such as money laundering, tax evasion, irregular tax returns, which gradually be connected to these "tax haven" together.

这些离岸公司在帮助众多企业进行国际贸易的同时,也让不法分子有机可乘,洗钱、偷税漏税、非正规报税也逐渐和“避税天堂”绑定在一起。

According to the data from the Organization for Economic Co-operation and Development,each year,tax evasion flow to overseas adds up to 1 trillion euros (equivalent to about 7 trillion yuan) with help of offshore accounts and corporations. Governments of many countries face huge annual losses of taxes so that they don't admit this happen any longer.

据经济合作与发展组织的数据,每年借离岸账户和公司逃税漏税流向海外的资金高达1万亿欧元(折合人民币约7万亿)。各国政府面对每年流失的巨额税收,自然不能坐视不管。

“Tax haven” , who can be the law executive ?

避税天堂风光不再,谁是执法者?

In July 2014, the Organization for Economic Co-operation and Development (OECD) launched an automatic exchange standard for financial account tax information , one of the most important criteria is - CRS.

2014年7月,经济合作与发展组织(OECD)推出了一个金融账户涉税信息自动交换标准,其中最重要的一个标准就是——CRS。

CRS - "Common Reporting Standard". It is a guideline for the exchange of financial account information for tax residents. One of the purposes is to combat the use of cross-border financial accounts to Evade Taxes.

CRS是Common Reporting Standard的英文缩写,中文为“统一报告标准”。它是一个对税收居民金融账户信息进行交换的指导准则,目的之一是打击利用跨境金融账户逃避税的行为。

And now CRS has become a big knife for all attempts to use offshore accounts to steal or escape tax evasion.

而如今CRS已经成为,高悬在所有企图利用离岸账户偷税逃税企业头上的一把刀。

Vigorously promoted by the Group of Twenty (G20) , there are totally 101 countries or regions committed to the implementation of CRS, and some traditional "tax haven", such as Bermuda, the British Virgin Islands BVI, Cayman Islands, Seychelles , Cyprus, etc. have also joined them.

在二十国集团(G20)的大力推动下,目前已有总计101个国家或地区承诺实施CRS,而一些传统的“避税天堂”,百慕大、英属维尔京群岛BVI、开曼群岛、塞舌尔、塞浦路斯等也已经加入其中。

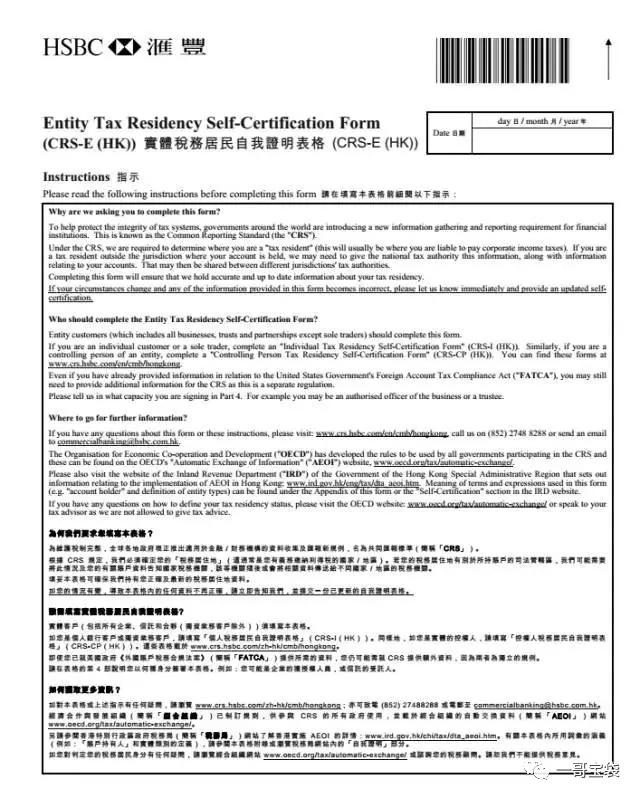

In Hongkong, for example, the local banks in Hongkong have basically introduced the relevant measures to implement the CRS, they required that the account holder must fill out a CRS entity self-proof form if the account is opened after January 1, 2017.

以香港为例,目前香港本地银行基本已经出台落实CRS的相关措施,他们要求从2017年1月1日之后开立的账户,持有人都必须填写一张CRS实体自我证明表格。

And about the accounts that were opened before January 1, 2017,the bank will also require holders fill the form one by one. After filling out this form, it means that you have fully agreed to announce your account asset information in the coming time .

在此之前的账户,银行方面也将逐一要求补填。填写了这张表格之后,就意味着你已经完全同意在时机到来时公布你的账户资产信息。

In front of CRS,you have to prove your "innocence"

在CRS面前,你得证明“清白”!

CRS is used to punish corporations that do malicious tax evasion and irregular tax return,to punish illegal transfer of assets to overseas enterprises or individuals.So,as long as your offshore company and account is doing regular legal business, than no need to fear CRS.

CRS打击的是恶意偷税和非正规报税的企业,打击的是非法将资产转移到海外的企业或者个人。所以,你的离岸公司和账户只要是正规经营,就不需要害怕CRS。

But first of all, you have to prove your "innocence", and the most favorable evidence to prove your "innocent" is - the audit report.

但是首先你得证明自己的“清白”,而证明您“清白”最有利的证据就是——审计报告。

Audit report - the most formal way to deal with CRS

审计报告——应对CRS最正规途径

1.What is the audit report?

审计报告是什么?

The audit report is a written report that can objectively reflect the financial situation and operating results of the audited entity, as well as a document of fairness.

审计报告是可以客观反应被审计单位的财务状况和经营成果的书面报告,同样也是具有公正性的证明文件。

In other words, you say your offshore account dealing with regular business,but without proof, then the audit report can prove innocence for you.

简单点说,你说你的离岸账户是正规经营的,但是空口无凭,而审计报告却可以替你“做主”。

2.How serious the consequence will be without the audit report?

不做审计报告的后果有多严重?

Generally speaking, Hongkong companies have two kinds of tax return: one is zero declaration, the other one is accounts audit tax return.

通常来说,香港公司的报税方式有两种:一零申报,二做账审计报税。

According to the Hongkong Inland Revenue Ordinance, if there is any business operation record in your company, but you do zero declaration or fake declaration, the Hongkong Government will give you very strict taxation and fines. If it goes to be serious bad, the person who is responsible for it can also be sentenced to three years' imprisonment.

按照香港税务条例,如果有经营还做零申报,属于谎报的违法行为,香港政府有非常严格的补税及罚款条理,严重的还可判处三年监禁。

After the punishment, the company's account credit will get great bad influence.

被处罚后对公司账户的信用将产生极大危害。

The bank will also ask for company audit report to verify the company's operation, especially after the implementation of the CRS, the bank's review to the company will be more stringent!

银行也会向你索要公司审计报告,来核实公司的经营情况,特别是在CRS实行后,银行对公司的审查将会更加严格!

If you don't provide audit report within the specified time limit,it will not be good to the opening and maintenance of your account.And if its going to be serious,then your existing account will be even closed!

如若无法在规定的时限内提供,会不利于账户的开立和维系,严重的已有的账户也会被关闭!

Hongkong company audit ≠ more tax

香港公司审计≠多缴税

The normal tax return process is to, firstly do audit, then submit to the Hongkong Inland Revenue Department.In the corresponding circumstances, you also can apply for offshore exemption.The Inland Revenue Department will verify your submitted audit information,if it is approved then your corresponding tax will be exempt.

正常的报税流程是先做账审计,提交给香港税务局,在相应情况下还可申请离岸豁免,税务局会核实你提交的审计资料,若批准即可豁免相应的税款。

Global tax is promoted transparency, tax audit becomes a trend

全球税收透明化,税务审计大势所趋

Global tax transparency is already become the trend. In the past, the behavior that using offshore accounts to enjoy the exemption of preferential practices will no longer be recommended.Foreign personal financial account assets will be completely transparent.

全球税收透明化已然是大势所趋,以往利用开设离岸账户享受免税优惠的做法将不再适用,境外个人金融账户的资产也将完全透明。

The audit report has high gold value, which will help you avoid taxes, fines and other troubles, but its requirements are also very high.

审计报告含金量高,能够避免补税、罚款等麻烦,但是它的要求也非常高。

What can HONEST do for you?

一哥宝袋企业之家可以帮你做什么?

HONEST has provided Oversea Company services to many customers for 10 years.This is the one-stop service,and it includes company registration opening accounts annual reviews,audit,tax returns.HONEST always helps customers with a professional and responsible attitude with a professional and responsible attitude.

一哥宝袋企业之家公司10年来,为众多客户提供离岸公司服务,包括注册、开户、年审、审计报税一站式服务,一直用专业负责的态度助力客户发展成长。

HONESTLAWFIRM wants to kindly remind you that early understanding of the international situation and doing a good job for precaution is the top priority.Any problem in CRS, HONEST is always ready to help you !

一哥宝袋企业之家提醒您,及早了解国际形势,做好防范准备,是当务之急。更多CRS的问题,一哥宝袋企业之家会在第一时间帮您解决!